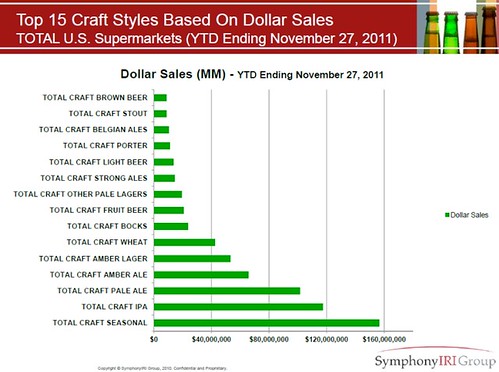

MC Basset, publishers of the Beer Bible — better known by its official title, “The Essential Reference of Domestic Brewers and Their Bottled Brands” — in their monthly e-mail blast, Style Trends, “provided a snapshot of (YTD) beer sales by beer style.” The data they use was compiled by the Symphony IRI Group (IRI), using “a data set that includes 15,000+ US grocery retailers.” The two charts below graph beer sales for calendar year 2011, through November 27th.

It’s also important to remember that by “beer styles,” they don’t mean styles in the ordinary sense used by homebrewers and judges in beer competitions, where the goal is to categorize beers of like characteristics together for ease of comparison. As IRI uses the term, they’re more of a loose arrangement of how they’re sold, since that’s their main focus. They also define what is “craft” beer differently than, say, the Brewers Association does, again because their goals are different. In their world, there are less “styles” than we’re generally used to, but what is “craft” is more loosely defined, allowing almost any beer that’s not a mainstream beer to be included.

In the first chart, it shows sales through Thanksgiving of the Top 15 craft styles based on dollar sales. There’s actually very little that’s surprising in this chart, as the category “seasonals” has been the top category for some time now, and IPAs, in second, is likewise how things have been for some time now. It basically shows that current trends are continuing as they have been lately.

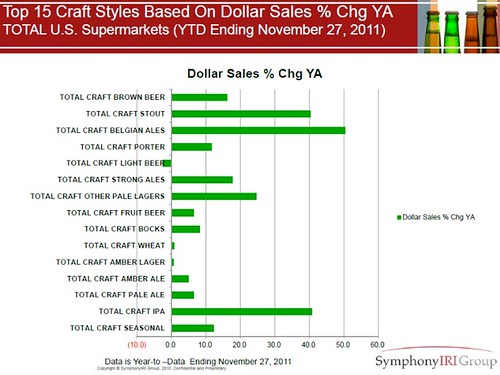

The second chart, however, I find more interesting. It’s showing the same fifteen categories, but by how their sales have changed, by percentage, over the same period of time from last year. In essence, this chart shows which kinds of beers are doing better this year than they did last year.

The second best recorded change, India Pale Ales — at just over 40% — has been trending up for a few years now, and hoppy beers continue to sell well. But what came in at number one is more surprising. Belgian Ales (really Belgian-style ales) are up around 50% over last year. Sure, it’s on a smaller base, but it’s still great to see more complex beers registering such a big increase. Undoubtedly, part of the reason for this is probably due to more outlets beginning to recognize customer demand and adding these beers to their set; but that, too, is a welcome development.

The other surprise is “stouts,” which are also up around 40% over 2010. And five of the beer styles are up over 10%, including “brown beer,” “pale lagers,” “porter,” “seasonals,” and “strong ales.” Only one style is down over last year, and that’s “craft light beer.” I presume that’s mostly Sam Adams Light, though there are a few others, such as Genny Light, Point Honey Light, Shiner Light and Yuengling Light that probably are included in that category.

Of all fifteen categories, all but three of them show fairly healthy growth. In addition to “craft light beer’s” slide, both “amber lager” and “wheat” grew only very slightly in 2011. Every other category grew by at least 5 or more percent from 2010 to 2011. Not bad in a recession.

do you have a suggested reason for stouts increase? Is it because more breweries are adding stronger stouts to their portfolios perhaps?

Just out of curiosity, I would like to know how they defined each of the styles on the list. You said that it is different than what the BJCP outlines, but I would like to know what each of these 15 contains. For example, does “craft pale ale” include just American pale ales, or does this include Belgian-style pale ales? Or are Belgian pale ales included in the Belgian category? Or does the pale ale category include English-style pale ales (bitters, ESB, etc.) also? Knowing how each of these are defined would make the results much more relevant and meaningful.

AMEN, Chris – obviously you’re well-attuned how stats can be manipulated!