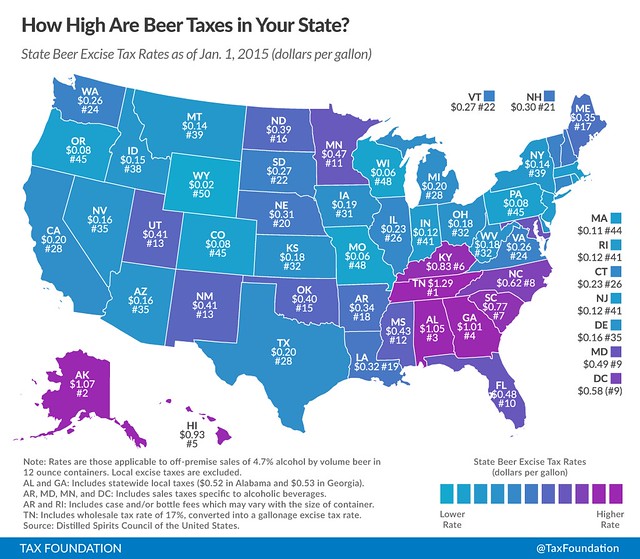

Back in 2009, I wrote a post about Beer Excise Taxes By State, based on data from by the Tax Foundation, and they also created a nice map of the 50 states with the individual beer excise tax brewers in each state has to pay in addition to the federal excise taxes, too.

They’ve now updated that map with more recent tax rates as of January 1, 2015. As they note, “[t]ax treatment of beer varies widely across the U.S., ranging from a low of $0.02 per gallon in Wyoming to a high of $1.29 per gallon in Tennessee.” They also acknowledge that “taxes are the single most expensive ingredient in beer, costing more than labor and raw materials combined,” citing an economic analysis that found “if all the taxes levied on the production, distribution, and retailing of beer are added up, they amount to more than 40% of the retail price.”

Taxes on beer in Canada are higher for sure. However, Craft beer prices are pretty well the same as in the US. Does that mean that the brewers actually make more money from their beer in the US, but the gov’t in Canada make more money from beer than the brewers? If so, that is just wrong.

Interesting graphic, but nobody proofed it. The flaws:

1. There are 51 entites represented, DC being #51.

2. There’s no 49 or 51 (which belongs to Wyoming; WI & MO would be tied 49-50)

3. Equal rates (as imentioned above) aren’t annotated as ties.

However, what was kind of surprising was that 8 of the top 10 are south of the Mason-Dixon line, & that 2 of those (have) had decent brewery presence (Carling/National in Baltimore MD; A-B in Tampa FL) for a long time. Also surprises me that SN & New Belgium were willing to set up 2nd plants in NC, given the huge diffs in taxes/gallon (unless state tax rates are based solely on sales vice production within the state).