![]()

With a week to go before the U.S. Presidential election November 4, I thought I’d share one of my favorite quotes by our 16th President: Abraham Lincoln.

“I am a firm believer in the people. If given the truth, they can be depended upon to meet any national crisis. The great point is to bring them the real facts, and beer.”

— Abraham Lincoln

Unless I hear otherwise from Bob Skilnik, I’m going to assume this is a quote that Honest Abe actually either uttered or wrote down on the back of an envelope. Though Lincoln is now generally reputed to have been a teetotaler, in his time some accounts do contradict that and say that on occasion he did drink in moderation. “Reliable testimony indicates that Lincoln was a light user of beverage alcohol.”

He was certainly pragmatic enough to understand beer’s importance to the economy, especially when during his first term he turned to the beer industry, among others, to help finance the Civil War. In Brewing Battles, by Amy Mittleman, she details how in July of 1861, the US Congress (or a least what was left of it in the north) levied the first income tax on the remaining states in order to raise money to fight the war with the southern states. By the end of the year, Congress realized it wasn’t enough and they needed a way to raise more funds for the war. In a special session in December 1861, Congress reviewed a request by the Secretary of the Treasury, Salmon P. Chase, to raise the percentage of income tax slightly and levy excise taxes on a number of goods, including beer, distilled spirits, cotton, tobacco, carriages (the automobiles of the day), yachts, pool tables and even playing cards, to name a few. The amendments passed, and Lincoln signed them into law July 1, 1862. They took effect September 1. Several weeks later, the first trade organization of brewers, the United States Brewers Association (USBA), was founded in New York. They held their first national convention in 1863 and elected Frederick Lauer as their first president. Lauer owned a brewery in Reading, Pennsylvania, my home town, and I remember the statue of him in City Park as a child. It was the first statue erected in Reading. But I digress.

Excise taxes are a “type of tax charged on goods produced within the country (as opposed to customs duties, charged on goods from outside the country).” The excise taxes were intended to be “temporary” but it was the beginning of temperance sentiments in the nation, and many people objected to alcohol on moral grounds. In the decade following the war, most were rescinded, but the taxes on alcohol and tobacco were the only two to remain in force, and in fact are still in effect today.

The only reason these excise taxes remained after the Civil War was primarily on moral grounds, coming from prohibitionist organizations. And I think that’s still relevant in 2008 because today’s neo-prohibitionists are also trying to use a moral sledgehammer to raise taxes on alcohol in an effort to put beer companies out of business and/or bring about another national prohibition. In state legislatures in many states, neo-prohibitionist groups are trying a variety of tactics to further their agenda. Usually it’s couched in propaganda that pretends they’re concerned for the children, or people’s health or some other hollow claim that hides their true aims.

I still find the argument strange that there should be higher taxes on products some people find morally objectionable. I find soda morally objectionable because it’s so unhealthy that it’s contributing to a nation of obese kids (and adults) — not to mention that beer in moderation is much healthier for you. But I wouldn’t argue pop should have an excise tax. The very concept of a so-called “sin” tax seems antithetical to the separation of church and state. Sin is a religious concept, and should play no role whatsoever in our government. Making people pay a higher price for goods that other people don’t like seems not only a little cruel, but also contrary to freedom of religion, because those are the morals people are using to deny people getting (or making prohibitively expensive) certain goods that not everyone agrees are sins. By using one set of morals as the basis for a particular law (in this case an excise tax) it ignores other sets of morals that differ from the prevailing one. That’s how a theocracy works, and we’re not one yet, despite recent efforts to make religion a central issue in government.

What would Abe Lincoln have thought about all this? Well, first I think he’d be horrified that for the most part the “truth” he felt the people needed to “meet any national crisis” is not much a part of our mainstream media nor of the political process in particular. There are very few “real facts” in play. What there is, is propaganda and the manipulation of quasi-factual information distorted to suit an agenda. All that’s left, really, is the beer.

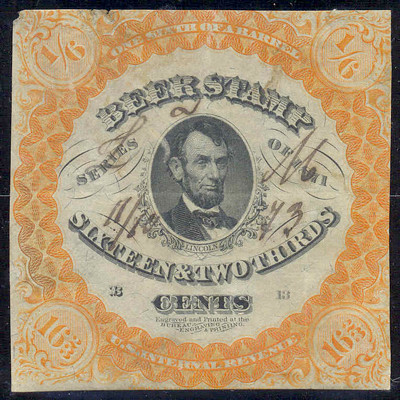

This beer stamp for 16 2/3 cents, to pay the tax on a 1/6 barrel of beer, depicting Abraham Lincoln, is believed to be from 1871.

Your use of a “freedom of religion” argument against importing a moral judgment from a religion into the legal system cuts as much against rules against killing, theft and the like as against sin taxes. The essential problem with using “God’s Will or Word” was long ago revealed by Socrates in the Eutyphro, when he asked whether a certain moral rule is a good because it was willed by God or whether God willed it because it was a good rule. His point was in seeking good reasons for the moral rules we adopt the citing of a text, even a text of divine provenance, doesn’t work. So, I agree that the importation of moral rules against alcohol isn’t valid. By the way,he best work I know on reaching reflective judgments on these moral/legal matters is that of John Rawls.

Jim: Lighten up and have a beer.

I agree. Why don’t we tax diapers or formula the same as we tax “sin” goods? Patrick Henry would have beaten down these “moralists”.