Yesterday, the Brewers Association released its list of “50 Fastest Growing U.S. Craft Breweries of 2018.” This is the second year for the list, and I’m glad they started creating it last year, because the annual Top 50 list has grown increasingly static over the years, and isn’t a good way to see who’s shaking things up anymore. Most of the movement tends to now be confined to the bottom half or even the bottom quarter of the list, with minimal changes above that. This list, on the other hand, sees new breweries on it each year (at least so far) and gives a better picture of which breweries are moving product at a faster pace than the previous year. And while it’s probably on a small base, it still shows who’s worth watching.

From the press release:

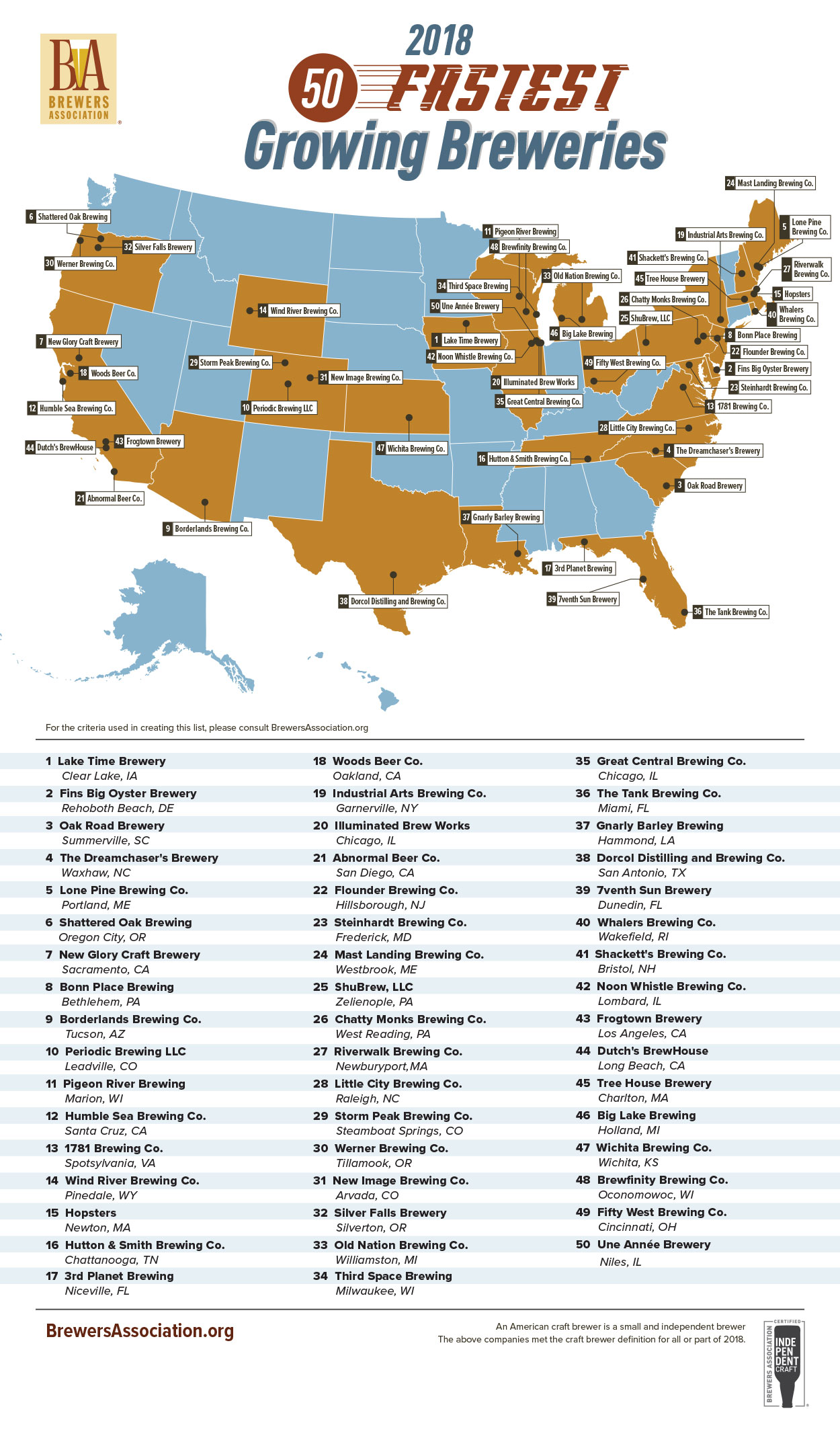

Representing 27 states across the U.S., these small and independent breweries experienced a median growth of 163 percent with the median size being 1,350 barrels of in-house production in 2018. Breweries on the list range from 50 barrels to more than 40,000, and grew from less than 70,000 barrels collectively in 2017 to more than 170,000 barrels in 2018. As a group, these brewing companies represent approximately 10 percent of total craft growth by volume for the year, and include 13 brewpubs, 35 microbreweries, and two regional craft breweries.

“Even as market competition continues to increase, these small and independent breweries and brewpubs demonstrate there are still growth opportunities across a diverse set of regions and business models,” said Bart Watson, chief economist, Brewers Association.

In my neck of the woods — California — six breweries made the list. That represents 12% of the total. Half of the California breweries are in the Bay Area and Northern California, and they’re all in the top half of the list with one, Sacramento’s New Glory, in the Top 10. They opened in 2012. Of the other two, Woods Beer Co. has several locations

This is a shortened version of the methodology they used, for the full write-up, see the BA’s press release.

Growth is measured based on production at their own facilities. Breweries must have opened by December 31, 2016 or earlier to be considered. It only includes breweries that reported 2018 production to the Brewers Association’s annual Beer Industry Production Survey; breweries with staff estimates or data from state excise tax reports were not considered. Breweries also needed a validated production figure for 2017, either via the production survey, or state excise tax data.