![]()

Given the NFL owner’s wanton disregard for their fans with the labor dispute debacle earlier this year, I’ve been paying much less attention to the football season. I check in to see if my beloved Packers have won, but that’s about it. For a number of years now — since I’ve had kids — I rarely go to a live game, usually because it’s such a time-consuming hassle and so expensive, in part because there’s four of us so costs rise exponentially. That’s especially true when it comes to beer, if you can even find anything worth drinking.

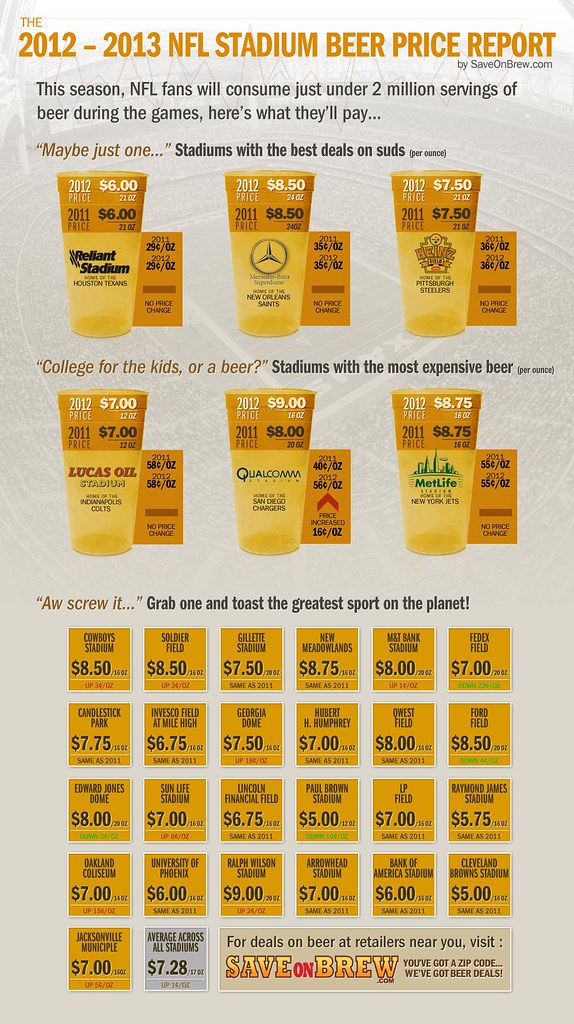

To help find a better deal, and to prove my point, Save on Brew looked at beer prices at the 32 NFL stadiums in a post entitled the 2012 – 2013 NFL Stadium Beer Price Infographic.

Here’s what they found:

Going to the game? It’s gonna cost you. According to FanCostExperience.Com (and the source for our stadium data), prices are rising across the sport. The average beer is up 15 cents from last year at $7.28. In this economy, every cent counts.

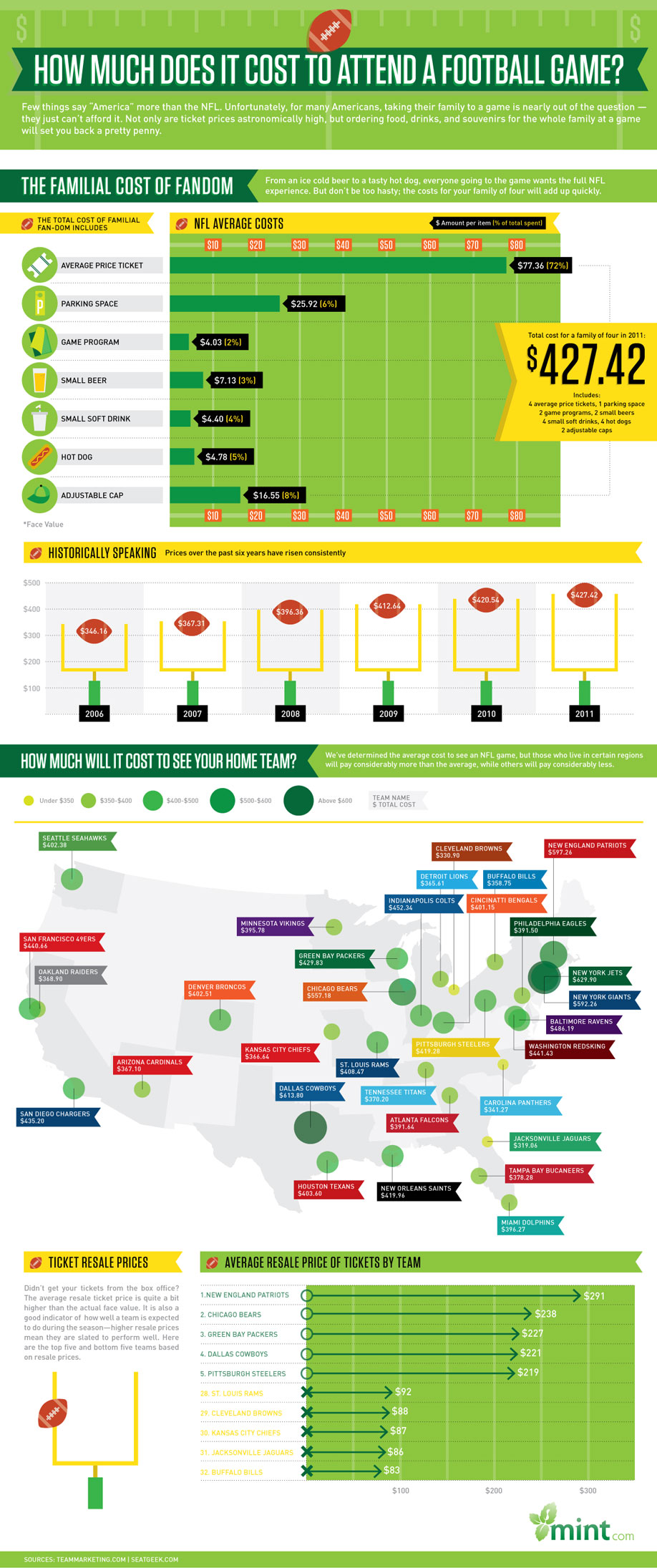

Rounding out the price-assault on the American public, the average NFL ticket is $78.38 (that’s a regular ticket, the “premium ticket” average is $243.70), a soft drink is $4.57, a ‘dog is $4.84, parking is $27.35, a program is $4.06, and a cap celebrating your favorite team will set you back $21.38 (on average) and, of course, a few of those $7.28 beers adds up pretty fast. In fact, a family of 4 will spend, on average, $443.93.

So wow, that’s even more expensive than I’d thought. That makes movie theater food and drink look like an absolute bargain. I guess they need to make that much profit so they can pay the referees. I feel so sorry for the owners, that they must be struggling so much that they need to charge close to six times the retail price for a beer. Because if the average price for a beer at an NFL stadium is $7.28 for 17 oz., that’s 42.8 cents per ounce! That works out to be about $5.14 for 12 ounces. A six-pack of Bud Light at my local BevMo costs $5.79, making it pretty close to six times the price. Now that’s gouging.

For a mainstream craft beer it’s almost as bad. A six-pack of Sierra Nevada Pale Ale costs $8.99 at BevMo, meaning 12 ounces of pale ale will cost you more than half of the price of an entire six-pack outside the stadium.

Notice the average cost for a family of four? $444! Seriously, how many people can afford that on a regular basis? Another similar survey of NFL prices on Visual.ly, entitled The Real Cost of Attending a Game, likewise concluded that the average cost to a family of four is $427.42. In that survey, they found the average price for a small beer to be $7.13, a pretty similar result. Given how much money the owners make, it it really reasonable to charge so much for tickets and other concessions at the game? I understand that in some sense they’re market prices. There are enough people willing to pay that much, and many games are sold out or nearly so. But does that make it right? Especially when owners complain they can’t afford to pay the refs. Every few years they fleece the community in which they live, threatening to move the team if they’re not given free money, or at least tax relief, to build a new stadium they probably don’t need. Don’t believe that? Read Field of Schemes.

It’s really a shame. I love the game. I like watching the games, cheering on my favorite team, especially with my son. I know it’s a business. I get that. But sports is really a part of the entertainment industry, so it’s not exactly like other businesses. As the recent strikes in baseball, basketball and football have shown, team owners really seem to believe that the people who consume their products — the fans — don’t matter all that much. But they could ease up on the beer prices and still make a healthy profit. That’s a decision I could drink to.

vs.

vs.