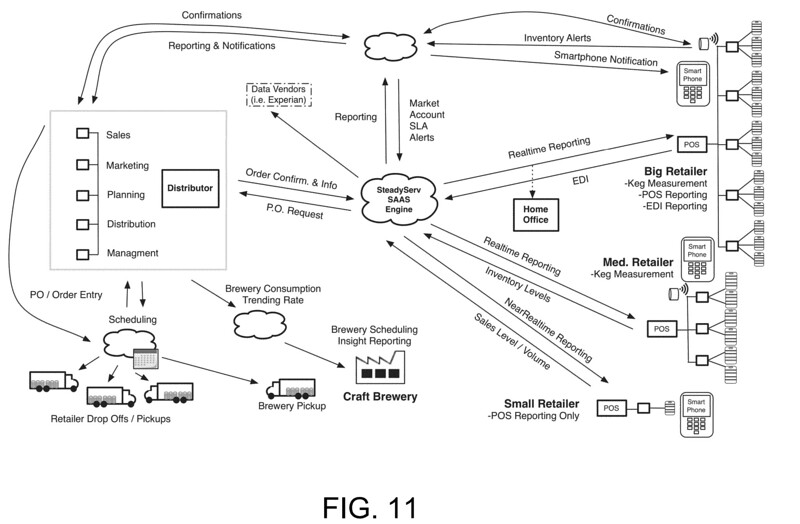

Today in 2013, US Patent 20130314244 A1 was issued, an invention of Steve Hershberger, Steve Kremer, Matt Mayer, and Mark Kosiarek, assigned to SteadyServ Technologies, LLC, for their “Draft Beer Supply Chain Systems and Methods.” Here’s the Abstract:

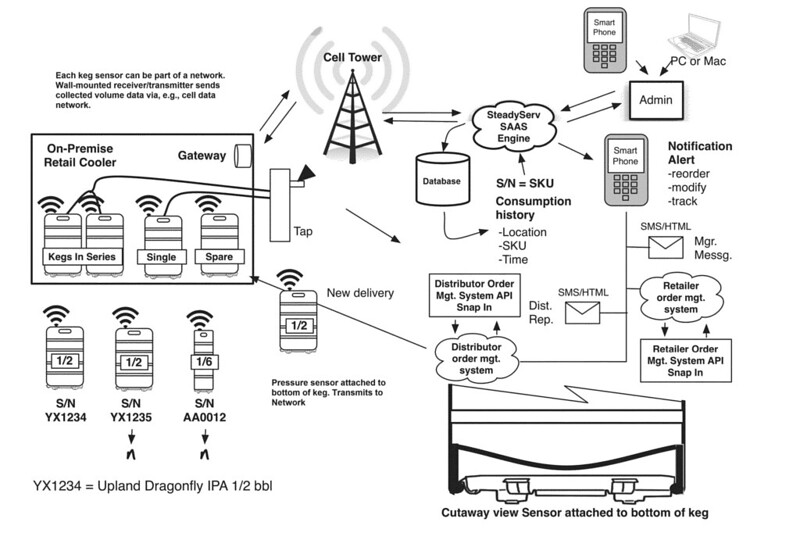

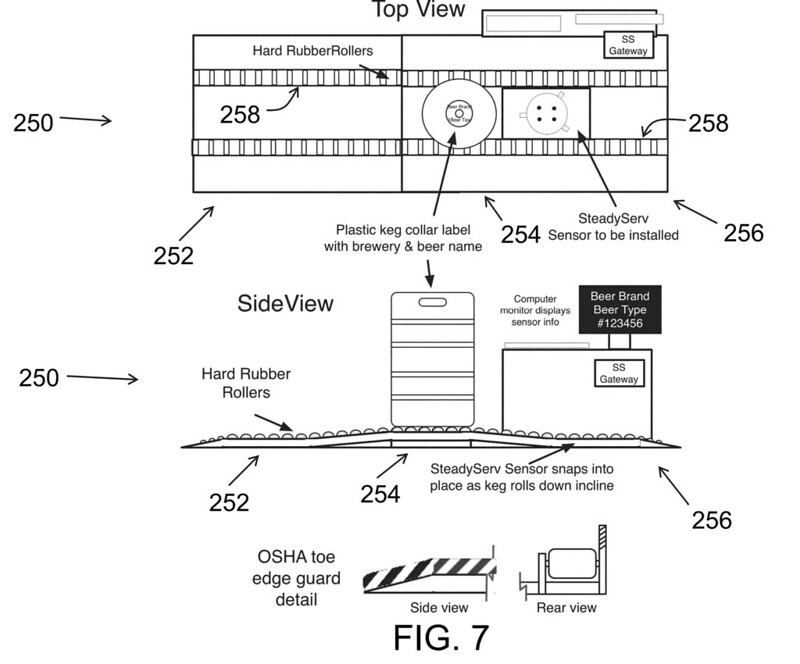

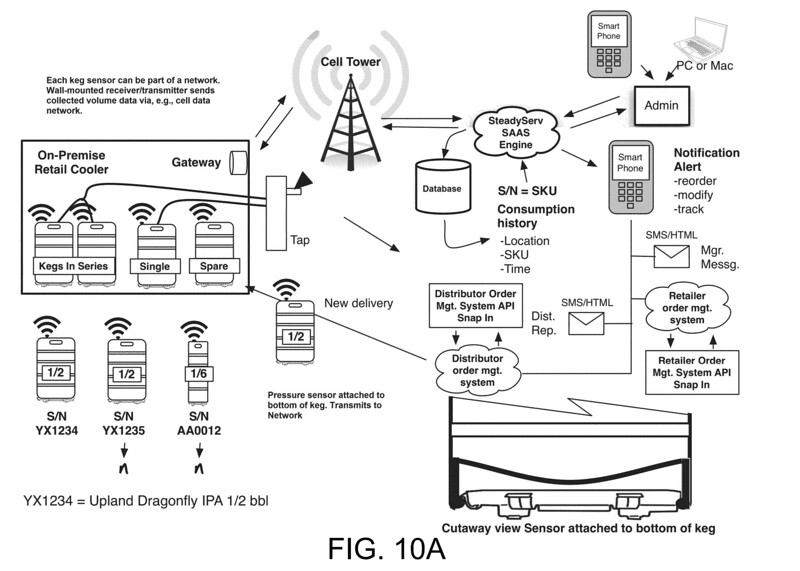

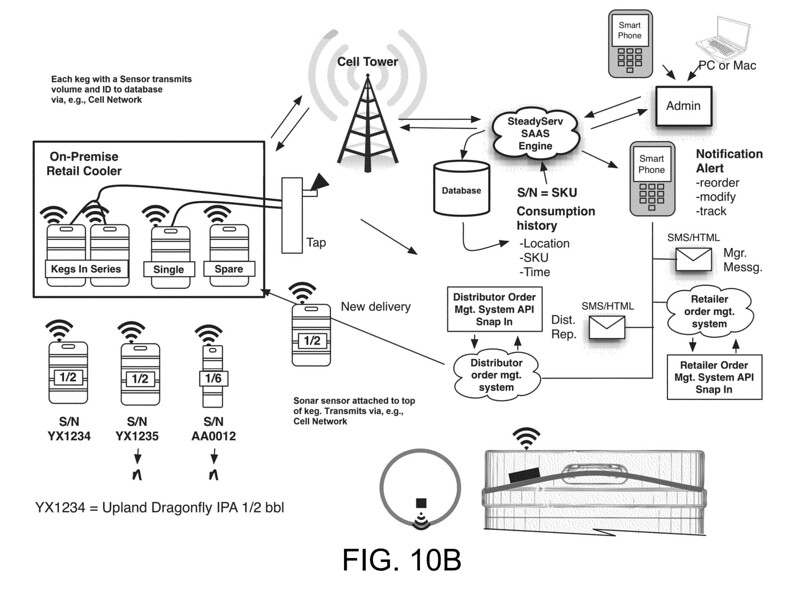

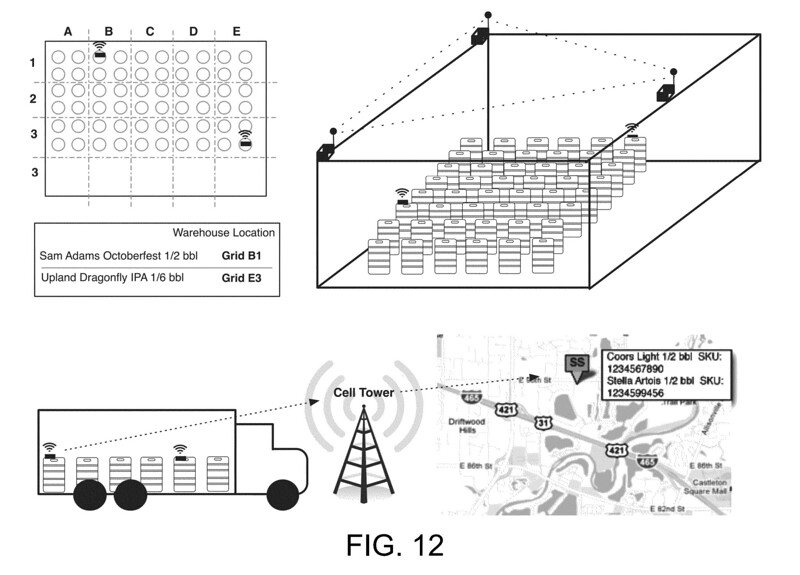

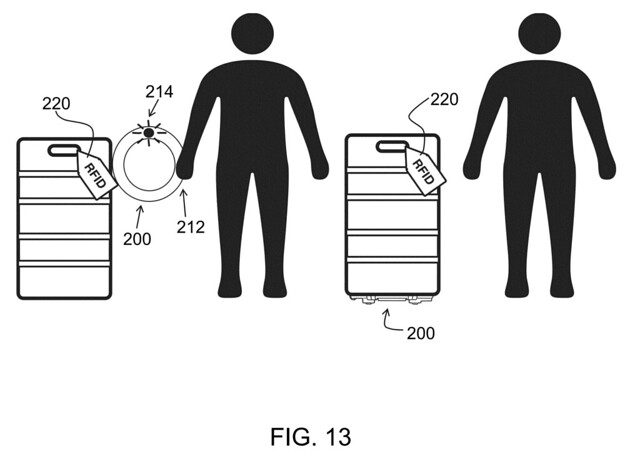

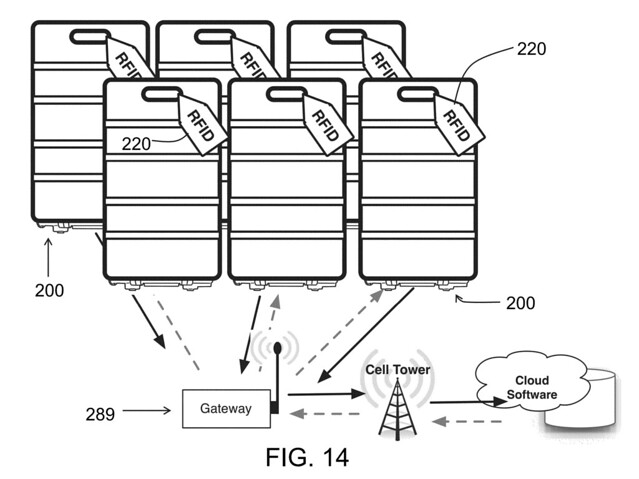

Supply chain systems and methods are disclosed for monitoring fluid levels in liquid containers, such as kegs. Embodiments include sensors that fit within a keg’s false bottom, measure the weight of the keg, and transmit the weight information to a computer database via a wireless network. Other embodiments include an RFID device with information about a characteristic of the liquid within a keg (such as brand and/or type of beer) that may be attached to the keg and paired with the sensor so the sensor can transmit information about the characteristic of the liquid in the keg. In alternate embodiments, the sensor’s transmitter is short range and an uplink/gateway is used to receive information from the sensor and relay that sensor’s information to a broader wireless network. Multiple containers in close proximity may each be fitted with an RFID device and sensor and communicate their individual information to the database.