![]()

Daniel Defoe observed in 1726 that nothing was more certain than death and taxes, and sadly, that still holds true nearly three centuries later. It seems more likely that we’ll lick that immortality problem before taxes ever become a thing of the past. And few taxes are more certain to be under attack than alcohol taxes, a favorite target of the anti-alcohol groups, whose incessant calls for their increase have only grown louder as the economy is in free fall. Because what you want to do in a sinking economy is make it harder for one of the few industries doing well to keep people employed, paying taxes and in business.

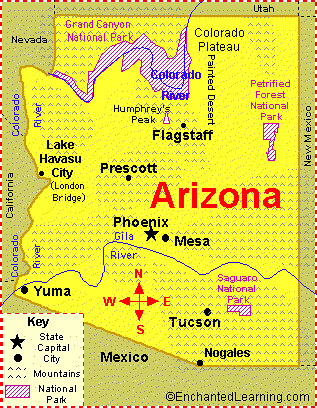

But that’s never stopped them before and it’s not stopping them now, as the latest shot over the bow from my friends at the Marin Institute was a press release today, Twelve States Stuck at Bottom of Beer Tax Barrel. It announces their new interactive map of Neglected and Outdated State Beer Taxes.

Here’s the entirety of the press release:

SAN FRANCISCO, Feb. 16, 2011 /PRNewswire-USNewswire/ — Marin Institute, the alcohol industry watchdog, launched its Neglected & Outdated Beer Taxes Map today. This new interactive tool helps those who want to raise beer tax rates to balance state budgets or erase deficits.

“Just point your cursor at a state and you can see the your current beer tax rate, the year of your last tax increase, and the loss of revenue from inflation,” said Bruce Lee Livingston, Marin Institute executive director and CEO. “We show the twelve states that have hit the bottom of the barrel in beer tax revenues and are the most overdue for an increase.”

The beer tax map quickly reveals states suffering the most from Big Beer’s influence. These are states that have beer taxes stuck at absurdly low rates set as long ago as the 1940s, and even the 1930s. “With almost every state struggling to find new dollars to fund critical programs, policymakers need to stop leaving beer tax revenue on the table,” said Sarah Mart, research and policy manager at Marin Institute.

The web site shows the twelve states with the “worst” beer tax rates in the nation, the “bottom of the beer barrel”: Georgia, Idaho, Kentucky, Louisiana, Michigan, Mississippi, Missouri, North Dakota, Pennsylvania, West Virginia, Wisconsin, and Wyoming. Six states (Kentucky, Louisiana, Mississippi, Pennsylvania, West Virginia, and Wyoming) have not raised their beer tax in 50 years or more.

The worst state is Wyoming, which has the distinction of the lowest tax rate – $0.02 per gallon – set in 1935, during FDR’s first term. Factoring for inflation, the value of Wyoming’s beer tax has decreased 94%. A simple 5 cents per drink increase in the state’s beer tax would yield $7.75 million in new revenue. Considering that Wyoming’s annual budget shortfalls are projected to hit $5 million by 2013, a modest beer tax increase would erase all budget shortfalls in the state, reduce drinking, and increase health and safety a little.

The map shows that in 47 states, the decrease in real value of the beer tax due to inflation ranges from 25 percent to more than 75 percent. “This is such a lose-lose scenario for the states,” added Mart. “States are losing revenue and cutting essential programs, especially those which mitigate alcohol-related harm, while the beer companies reap higher and higher profits. It’s time for states to stop their race to the bottom and raise beer taxes.”

And here’s their colorful map of beer taxes and when they were last raised, minus the interactivity. The interactive version you can see on their website.

But there are so many things wrong with their arguments that it’s hard to know where to begin. So I’ll start by being petty. Look at the first two words of the press release: “SAN FRANCISCO.” The Marin Institute is NOT in San Francisco, but in San Rafael, which is just north of the city in Marin County, hence their name. I’m sure that they used the more familiar San Francisco because nationwide, and especially worldwide, no one’s heard of San Rafael, but I can’t help but ponder that if they can’t even be accurate about where they’re located, what does that say about their commitment to the truth in more substantive issues?

First, let’s assume everything they say is correct (it’s not, but just for the sake of argument). The amounts realized according to their table of the states with the lowest taxes if their state excise taxes were increased by “10 cents a drink” ranges from $15.3 to $333 million, or an average of about $123 million per state. But state deficits are in the billions, with a “b.” The Center on Budget and Policy Priorities estimates around $350 billion. Even if you added up all twelve states, the additional taxes would be less than $1.5 billion, less than half a percent of the total (not a perfect number, but still indicative of the problem). The point is that raising the state excise taxes on alcohol comes no where close to doing anything meaningful about the budget shortfalls facing all but four or five of the states. All it does is punish and weaken one of the few functioning industries in a distressed economy.

Next, let’s talk about the idea that taxes should parallel inflation and be raised to match those levels. If that is indeed a public policy goal, shouldn’t it be applied across the board? If we accept that taxes should be raised every time inflation inches ever higher, then shouldn’t ALL taxes do likewise? Singling out the alcohol industry for such treatment is, again, just punishing one industry because one of their “watchdogs” doesn’t like them, despite all protestations to the contrary. I don’t want my taxes to go up anymore than I suspect you do, but if we need more money as a state, country and society, than I don’t see any other fair way to raise more money. Any scheme that falls disproportionally on any industry is de facto unfair to solve a problem that effects all of society. We should have done away with tax breaks for the rich, but that couldn’t even be talked about, much less implemented. Instead, let’s suggest the heavily regressive taxes on alcohol punish the poor even more than they already do.

The other unanswered question is how high to raise excise taxes and for how long? And while there’s no amount proposed at this time, since they’re merely providing the tools to sow discontent in individual states, I believe that’s because there’s really no amount too high for the anti-alcohol groups. Though unstated, it seems implicit in their rhetoric that no amount is enough and they’ll never be satisfied. I’ve never seen a discussion of what amount they might consider fair enough, or might balance the amount with their ability to stay in business (which is the only way companies could continue to actually pay their taxes). Is there an amount that might satisfy such organizations? If so, I’ve never seen it. Then, if fixing the economy is truly the aim of their proposals, should such taxes only be imposed as a temporary measure until the crisis is over? If you didn’t laugh when you read that, you don’t realize that taxes are almost never repealed, only imposed or increased. What I think this exposes is that this is simply a way to use current circumstances to harm the alcohol companies and make it harder for them to stay in business, falling especially hard on the small brewers.

What’s also conveniently left out of their argument, as always, is the current amount of taxes paid by alcohol producers. There’s more taxes paid on every bottle of beer than any other consumer good save tobacco. Those two products are the only remaining items that pay excise taxes, at both the federal and state level. And while I think most would agree that smoking offers no health benefits, beer (and alcohol more generally) in moderation most definitely does. If you drink one or two beers a day, the odds are you’ll live longer than either a teetotaler or a binge drinker.

I’ve tackled this before, so if you want background on the issue of beer taxes, see Abe Lincoln On Beer & Politics and Here We Go Again: Beer & Taxes.

How much does the brewing industry pay? As of 2008, business and personal taxes accounted for $35,283,148,850, consumption taxes account for another $11,172,946,867; or a total of $46,256,095,717 annually. The total economic impact of the beer industry alone pumps $198,152,918,964 into the national economy each year. And all those figures are not including wine and spirits which would push it significantly higher.

I think Defoe’s quote needs modifying to reflect modern society, adding that few things are more certain than anti-alcohol groups using a recession to further their own narrow agenda of making the alcohol industry pay for their perceived sins. I think I need one of Moonlight Brewing‘s tastiest beers, their black lager, Death & Taxes.