If you’ve been following the Marin Institute’s efforts to have San Francisco enact an alcohol fee, then you know that there was a Small Business Commission hearing last night at City Hall. Item 5 on the agenda:

Discussion and possible action to make recommendations to the Small Business Commission on Board of Supervisors File No. 100865 [Establishing an Alcohol Mitigation Fee.] Ordinance amending the San Francisco Administrative Code, Chapter 106, by adding Sections 106 through 106.28, to impose a fee on alcoholic beverage wholesalers and certain other persons who distribute or sell alcoholic beverages in San Francisco to: 1) recover a portion of San Francisco’s alcohol-attributable unreimbursed health costs, and; 2) fund administration costs. Presentation by representatives of the Marin Institute. Explanatory Documents: BOS File No. 100865 and report titled, “The Cost of Alcohol to San Francisco: Analyses Supporting an Alcohol Mitigation Fee.”

Yesterday, the Marin Institute also issued a press release, ‘Charge for Harm’ Alcohol Mitigation Fee Deserves San Francisco Small Business Support, in which they demonstrated how out of touch with reality they are by suggesting small businesses must support higher taxes, higher prices and the very real possibility of a loss of revenue. In case you missed it, I also wrote about that yesterday, too. Presumably, the Marin Institute thought last night’s meeting was a mere formality, but San Francisco business owners were a lot smarter than the Marin Institute gave them credit for.

The result of the hearing was that the Small Business Commission strongly asked supervisor John Avalos (sponsor of the alcohol fee ordinance) to delay a vote on the AMFO until after the August break, which is after Labor Day. Avalos has agreed and so we’ll all have more time to build our case against the AMFO and the faulty nexus study that does not support it. It will also afford an opportunity to spread the other side of the story and correct the propaganda, since so far most of the mainstream media coverage has been very one-sided, giving most people a false impression of the AMFO and its impact.

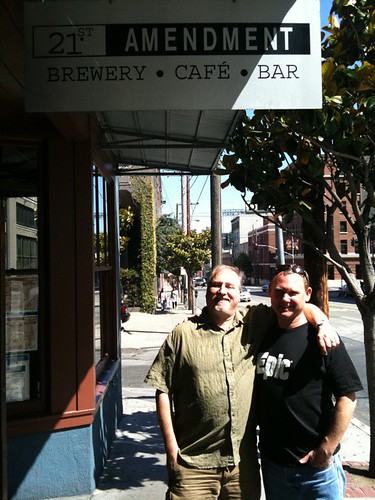

While it’s far from over, this is a great first round victory for the forces of reason and common sense. It will interesting to see how the Marin Institute spins this. Drink a toast tonight, perhaps in San Francisco or at least with a beer brewed in San Francisco.