If you read my rebuttal to San Francisco Chronicle columnist C.W. Nevius support of the proposed fee on alcohol in the city, then perhaps you recall that he interviewed the California Alliance of Hospitality Workers so he could appear to show both sides of the argument. It was not really in any way balanced, and in fact I think he used them as a straw man, though he did so in a way that I believe was incorrect at any rate.

Happily, the California Alliance of Hospitality Workers is fighting back, and is trying to get people to contact their local supervisor in San Francisco to have city residents ask their politicians to oppose the proposed fee. The e-mail to use is Board.of.Supervisors@sfgov.org. If you live in San Francisco and drink alcohol in moderation and responsibly, please contact your supervisor and ask him or her to oppose the ordinance.

You can also see their response to the proposed ordinance, Supervisors’ Short-Sighted Proposal to Tax Alcohol Will Hurt Hard-Working San Franciscans. They’ve also set up a Facebook page.

One additional important fact that they mention is that the required Nexus Study has still not been filed or made public. With the hearing to vote on the proposed ordinance a week away — July 14 — at the very least that’s stacking the deck and at the worst is complete bullshit.

Here’s just a few more reasons why this tax is unfair, particularly to craft beer:

- This legislation taxes beer by alcohol strength, putting a huge and cumbersome burden on brewpubs, self-distributing small brewers and wholesalers because each and every beer is taxed at a different rate.

- Craft brewers are not part of the problem. Craft beer is priced high and is a product of quality, not quantity. Craft beer drinkers do not abuse their beverages.

- With the “margin chain” and price point consideration, the tax will be much higher than five cents a drink. At retail off-premise, the increase will be about 50-75 cents a six-pack and on premise about 75 cents to a dollar per pint.

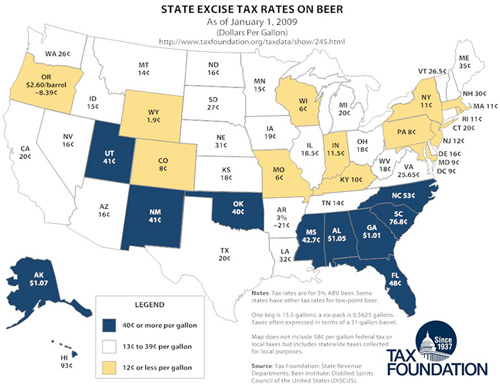

- Brewers are already heavily taxed. Small brewers already pay a state and a federal excise tax in addition to all other business and sales taxes. Combined, about 40-44% of the cost of a beer already goes to taxes.

- Higher drink prices in a singular market such as San Francisco will lead consumers to not come into the City for dining and entertainment.

- Higher taxes will lead to lost jobs, off-setting the new tax.

- The proposed tax would hinder the ability of craft brewers in the City to grow, employ more people and positively contribute to City’s economic recovery.

- Higher taxes will mean higher prices which means lower sales. If this tax in imposed, sales will decrease and craft brewers will not be able to sustain the ability to continue full employment or continue to invest in our business and community.