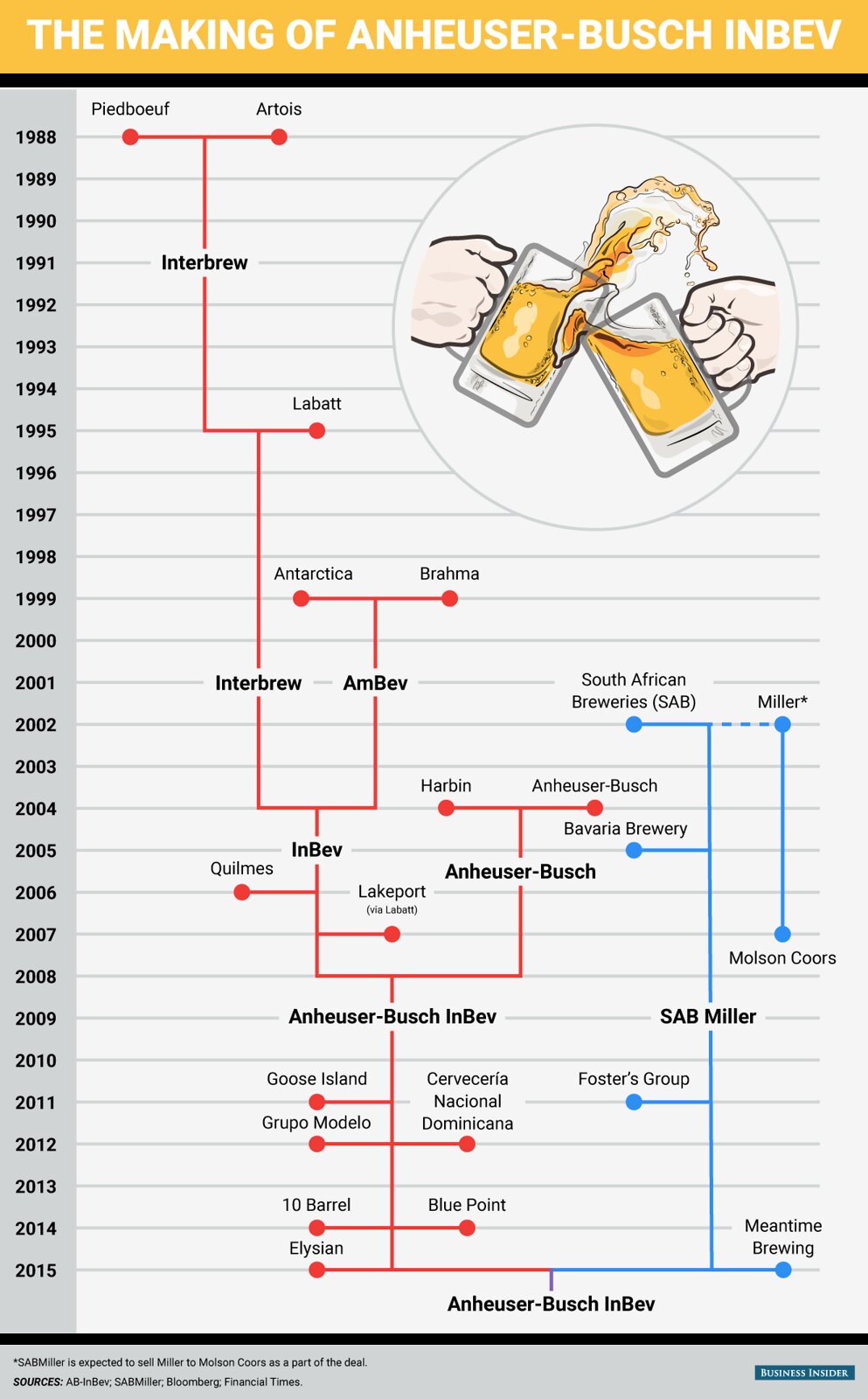

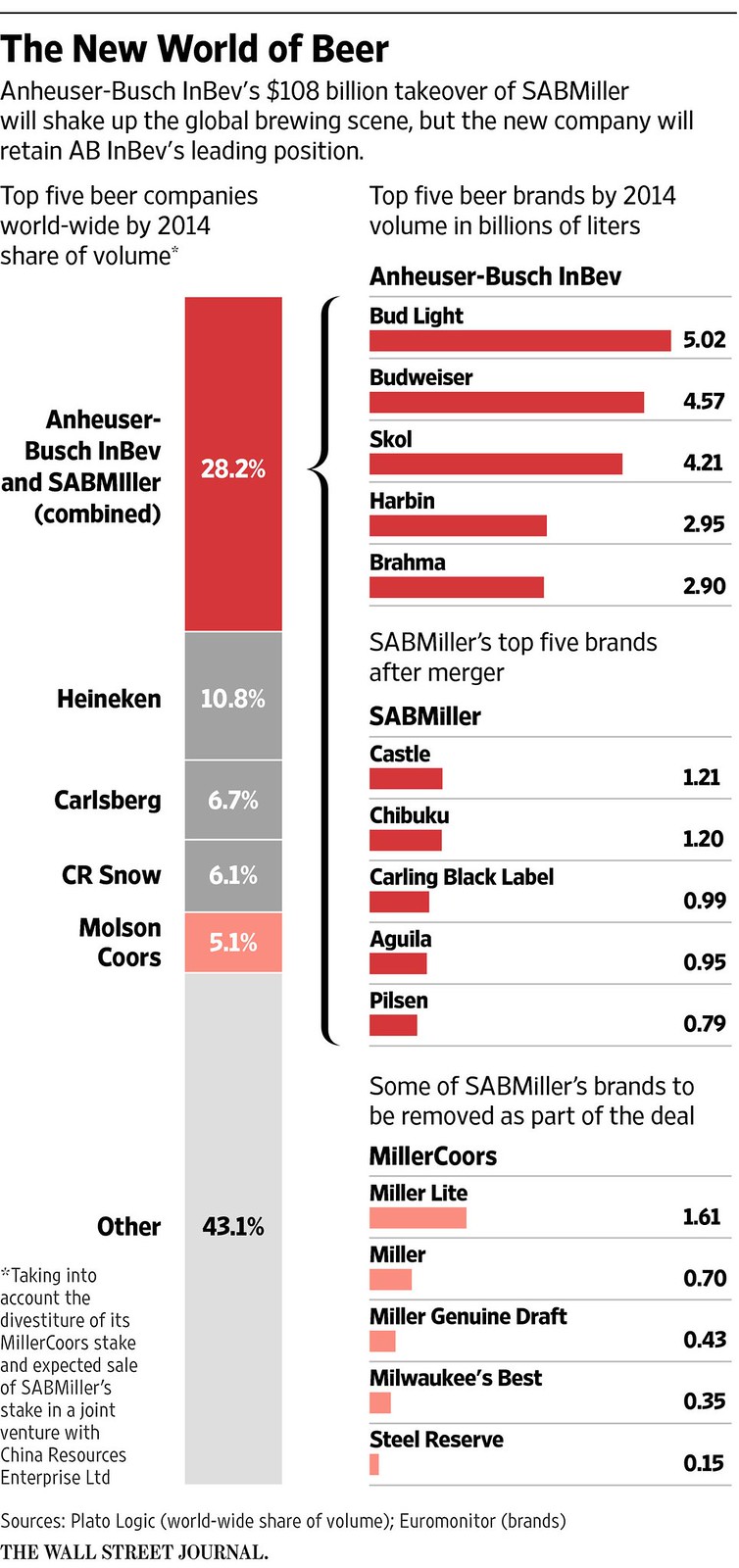

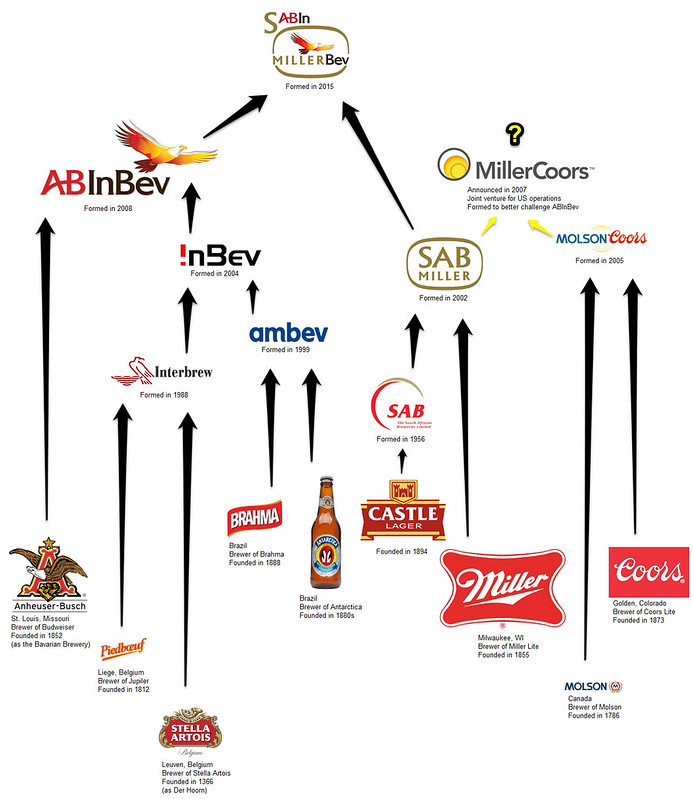

Anheuser-Busch InBev announced this morning that they were buying British brewer Camden Town Brewery, located in London. Despite having recently raised over £2.75 million through a crowdfunding campaign on Crowdcube (nearly doubling their £1.5 million target), which was purported to fund a second London brewery, Camden Town is quoted in the Guardian that “the businesses needed a major investor to fund the construction of a second brewery that will create 30 jobs.”

Jasper Cuppaidge, who founded the brewery just five years ago, also posted a short statement on their website:

The ‘craft’ brewing movement has seen incredible growth driven by innovation, quality and daring. Camden Town Brewery has been at the forefront of this revolution. The success and reputation we have built has been nothing short of incredible. That has been thanks to all of you and the great beers we’ve brewed.

To stay at the forefront of this movement and secure our future success, we have to build a bigger brewery, employ more people and gain access to an international distribution network.

We can’t do this on our own. That’s why I’m proud to say I’ve signed a deal with AB InBev.

This partnership is going to help us deliver our plans to grow. With AB InBev’s support we will expand our operations, create more jobs in London and continue to brew our great beer and get it to more drinkers. Read more here.

We are really excited about taking this opportunity to turn Camden, and the quality it stands for, from being an outstanding London brewer, to being a world famous one. We hope you are too.

If you’re one of our shareholders, we’ll be in contact soon with more details about what the news means for you. We’ll also be updating the investor site shortly with answers to questions you may have.

The terms of the deal, and the price, were not disclosed. The transaction is expected to close quickly, by January 7. Camden Town also posted a more traditional press release:

Camden Town Brewery today announced that it is partnering with Anheuser-Busch InBev (AB InBev) to pave the way for further growth and expansion. The partnership will enable Camden Town Brewery to expand its operations, bringing more of its popular canned, bottled and kegged beer to more people. The deal will see AB InBev acquire Camden Town Brewery.

Founded by Jasper Cuppaidge, the owner of The Horseshoe pub in Hampstead, Camden Town Brewery started full production in 2010. From an original staff of three people, it now employs a team of 95 and has sold 12 million pints in 2015. Their beers are available in over 1000 pubs, bars, restaurants and retailers around the UK, as well as further afield in Sweden, Australia and Japan.

The deal follows a successful bid by Camden Town Brewery to raise capital via crowd funding and will support the company’s plan to build a second brewery in London, employing 30 more people and meeting growing demand for its products. The partnership will enable Camden Town Brewery to brew more of its own distinctive beers and continue to innovate, while maintaining its focus on quality.

Jasper Cuppaidge said: “Our growth has been phenomenal. To keep up with the demand for our distinctive beers we’ve had to look at expanding our brewing capacity and team. AB InBev is going to be our strategic partner, helping us maintain the character and quality of our beers, while giving us access to the investment we need to drive Camden to being ever more successful at home and abroad.

“Opportunities like this come rarely. We believe we must have the ambition to grab this opportunity and turn Camden Town Brewery, and the quality it stands for, from being an outstanding London brewer to being a world famous one.”

Iain Newell, European Director of Specialities & Craft, AB InBev, said: “We have a passion for great beer. Camden Town is a creative business with a great range of brands that will complement our existing portfolio. We will support their ambitious plans for the future, using our expertise and global distribution network to help them get their great beer to more people.”